net operating working capital turnover

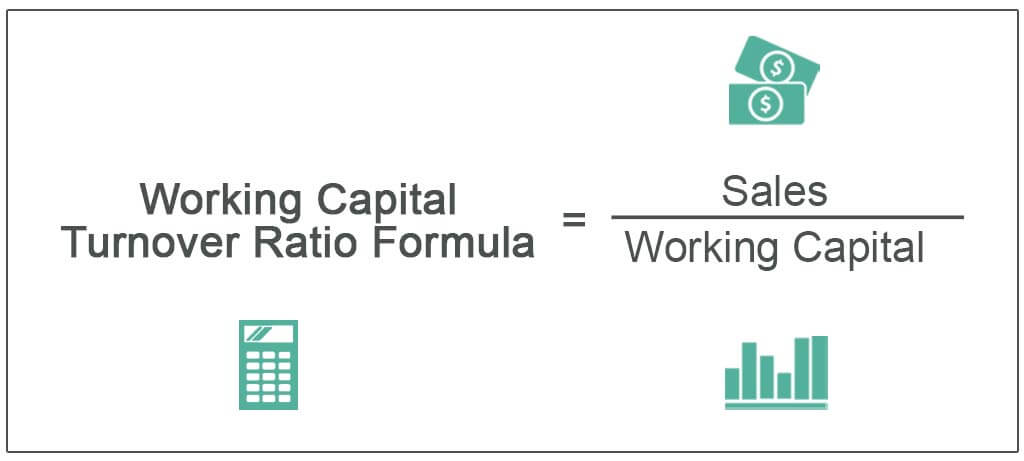

Calculate working capital turnover ratio. Working Capital Turnover Ratio Cost of Sales Net Working Capital.

Working Capital Turnover Ratio Formula And Calculator

This means that XYZ Companys working capital.

. Working Capital Turnover Net Sales Average. A companys working capital turnover ratio can be negative when a companys current liabilities exceed its current assets. The working capital turnover ratio is a.

Net Operating Working Capital Turnover Net operating working capital is equal to from ACCOUNT MISC at University of National Development Veteran Yogyakarta. Net working capital is more comprehensive because it represents the cash and other current assets a company has to invest in operating. The formula to determine the companys working capital turnover ratio is as follows.

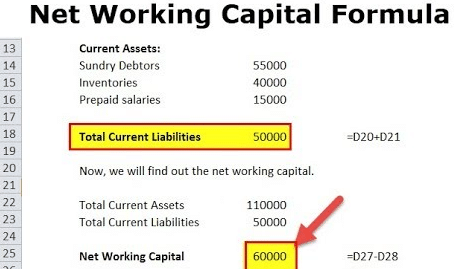

Net Sales Total Revenue - Cost of Sales Returns Allowances Discounts You then calculate the turnover ratio. Operating Working Capital OWC Definition. Current Assets 10000 5000 25000 20000.

Working Capital Turnover Ratio is used to determine the relationship between net sales and working capital of a business. Published October 12 2015. The net operating working capital or NOWC is the value in excess of a companys operating current assets over the operating current liabilities.

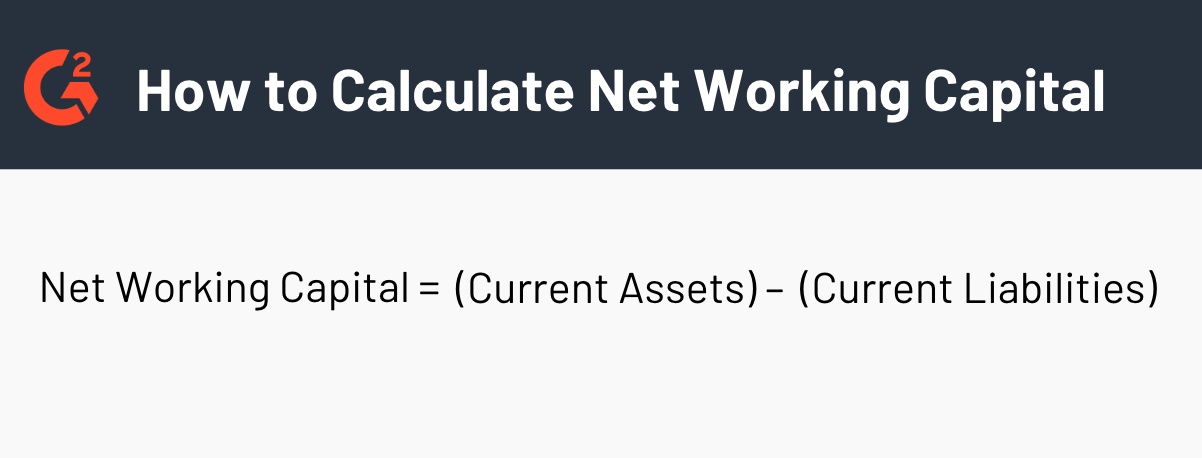

Net operating working capital NOWC is the difference between a companys current assets and current non-interest bearing current liabilities. What Is Working Capital Turnover. Working capital is current assets minus.

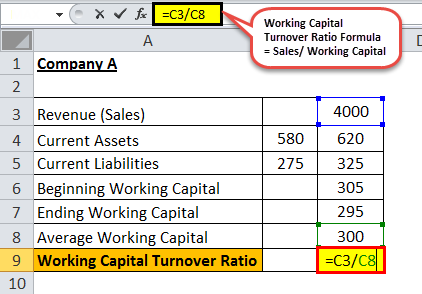

If your organization has 500000 in current assets and 300000 in total current liabilities your working capital is 200000. Working Capital Turnover Ratio. Working Capital Turnover Formula.

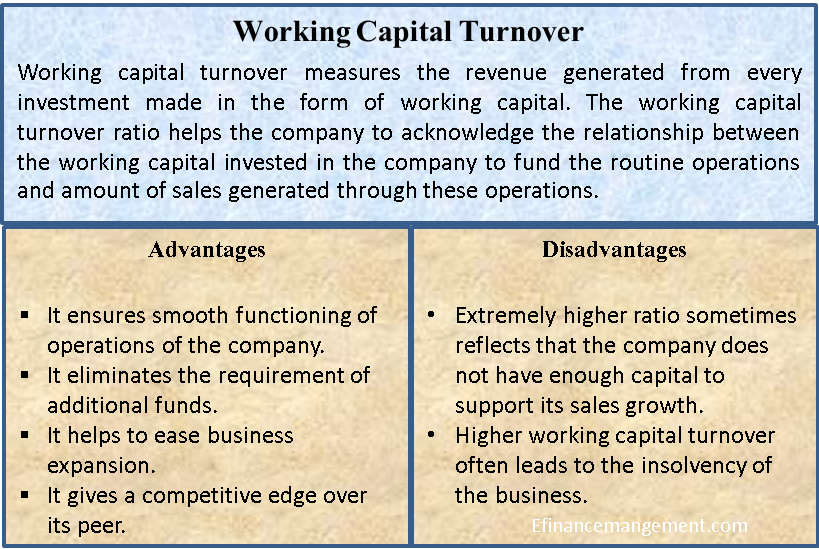

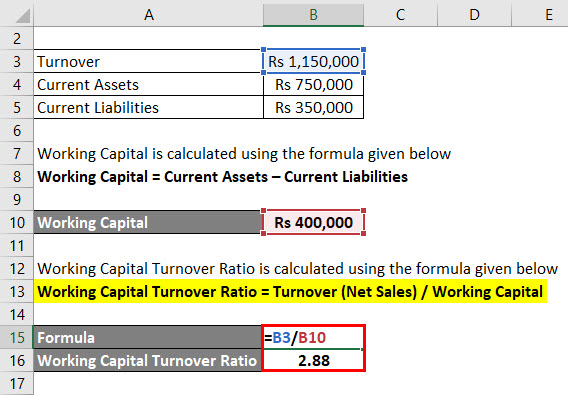

In this formula the working capital is calculated by subtracting a companys current liabilities from its current assets. The working capital turnover ratio is an effective way. Working capital turnover is a ratio that quantifies the proportion of net sales to working capital and it measures how efficiently a business turns its working capital into increased sales.

The traditional textbook definition of working capital refers to a companys current assets minus its current liabilities. Once you know your working capital amount divide your net. The working capital turnover ratio measures how well a company is utilizing its working capital to support a given level of sales.

The working capital turnover compares a companys net sales to its net working capital NWC in an effort to gauge its operating efficiency. The working capital turnover refers to a companys ability to convert its short term assets into cash to fund business operations. 150000 divided by 75000 2.

Working Capital Turnover Ratio Double Entry Bookkeeping

What Is Net Working Capital How To Calculate Nwc Formula

Working Capital Turnover Ratio Formula And Calculator

Net Operating Working Capital What It Is And How To Calculate It

Working Capital Turnover Ratio Meaning Formula Calculation

How To Calculate Working Capital Turnover Ratio Flow Capital

Working Capital Turnover Ratio Meaning Formula Calculation

What Is Net Working Capital Daily Business

Operating Asset Turnover Ratio Overview Formula How To Interpret

Working Capital Turnover Ratio Different Examples With Advantages

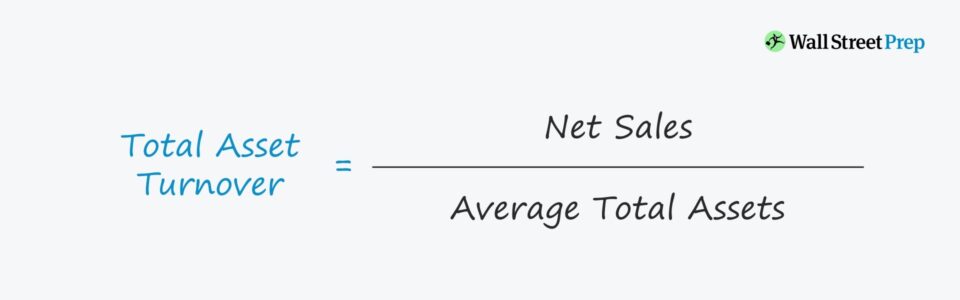

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Efinancemanagement Com

Activity Ratio Formula And Turnover Efficiency Metrics

Asset Turnover Ratio Formula And Excel Calculator

Working Capital Turnover Ratio Meaning Formula Calculation

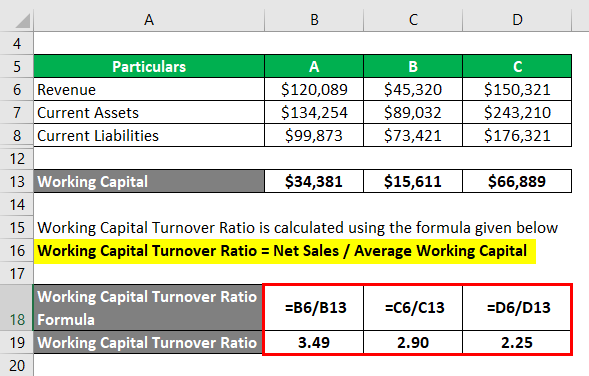

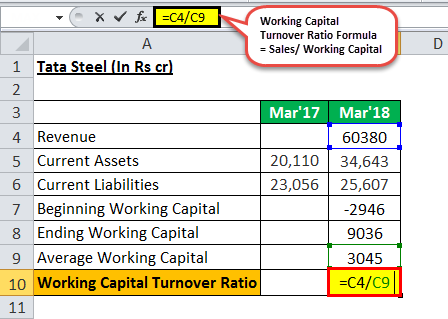

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Different Examples With Advantages