b&o tax rate

To calculate this amount multiply your taxable gross revenue amount by the tax rate. This evening for four years in a row Mayor.

City Of Tumwater B O Tax Form Fill Online Printable Fillable Blank Pdffiller

Contact the city directly for specific information or other business licenses or taxes that may apply.

. 50000 or less per year. New Tax Rate for 2023 Revenue and After. Greater than 50000 per year.

How the tax works. The Township tax rate had no increase in 2021 2020 and 2019 after having been. This is the total of state county and city sales tax rates.

Additional information and specifics related to your business may be obtained in chapters 403 404 409 410 and 414 of the Bellevue City Code or by contacting the citys Tax Division. For example if the retail. The state BO tax is a gross receipts tax.

It is measured on the value of products gross proceeds of sale or gross income of the business. Your gross revenue determines the amount of tax you pay. Washington unlike many other states does.

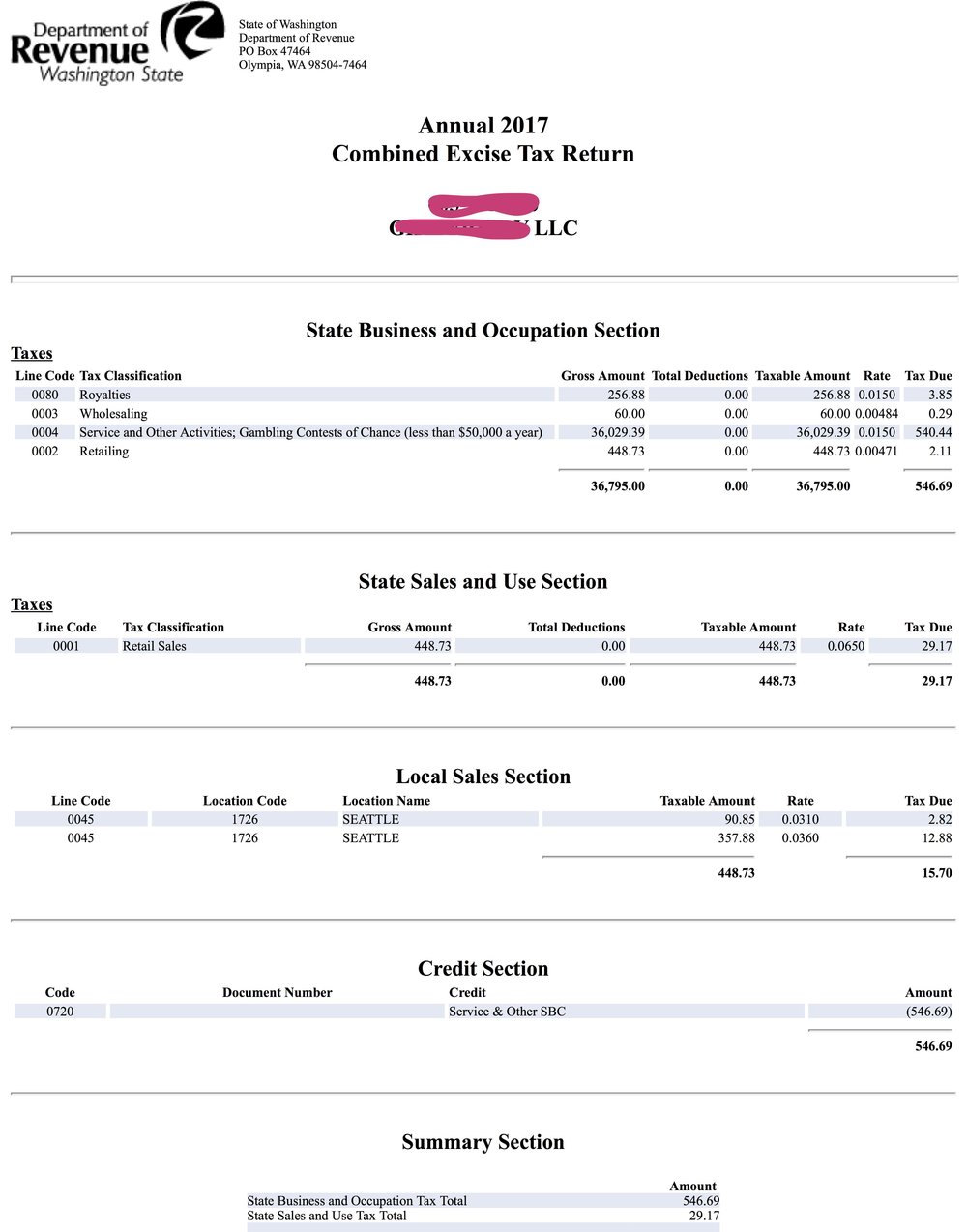

Washingtons BO is an excise tax measured by the value of products gross proceeds of sales or gross income of a business with over 30 different classifications and associated tax rates. The minimum combined 2022 sales tax rate for Ridgefield Park New Jersey is. Participation in a composite return is elective.

0002 times the net taxable revenue. Current Tax Rate for 2022 Revenue and Before Retailing 00050. The gross receipts BO tax is primarily measured on gross proceeds of sales.

What are the penalties for unpaid BO Tax. The New Jersey sales tax rate is currently. For fourth year in a row Piscataway Township has a 128 percent lower municipal tax rate.

BO Tax Rate Change Beginning Jan. In addition retail sales tax must also be collected on all sales subject to the retailing classification of the BO. The current gross receipts tax rate of 01496 percent applies to all gross receipts tax classifications.

1355 are as follows. The Retailing BO tax rate is 0471 percent 00471 of your gross receipts. If the nonresident individual is going to be taxed at a higher rate.

V voter approved increase above statutory limit e rate higher. Have a local BO tax. If any taxpayer fails to remit the BO return or fails to remit in whole or in part the proper amount of tax a penalty in the amount of five percent.

Piscataway Township hits a four-year stride with a 128 percent lower municipal tax rate. For Tax Year 2017 the highest tax rate was 897. 3 rows B O tax rates When paying the B O tax to the Department of Revenue you declare your.

The rates established by Ordinance No. April 20 2021 Four is the new big number in Piscataway.

B O Tax Annual Report To Seattle Seattle Business Apothecary Resource Center For Self Employed Women

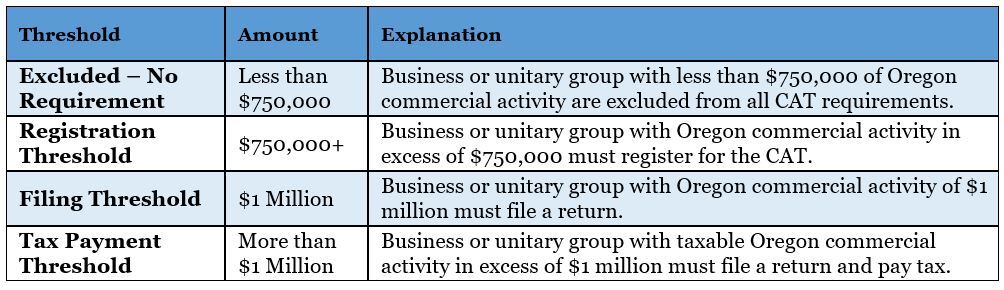

Ghj Changes To Gross Receipts Taxes Washington And Oregon Updates For 2020

When Are Washington State B O Taxes Due In 2021

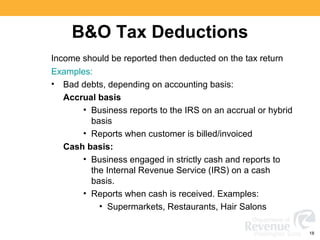

Washington State Sales Use And B O Tax Workshop

B O Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

B Amp O Tax Guide City Of Bellevue

B O Tax Nexus In Washington Evergreen Small Business

Corporate Tax In The United States Wikipedia

Wa Dor June Combined Excise 2012 Form Fill Out Sign Online Dochub

Cf Images Us East 1 Prod Boltdns Net V1 Static 561

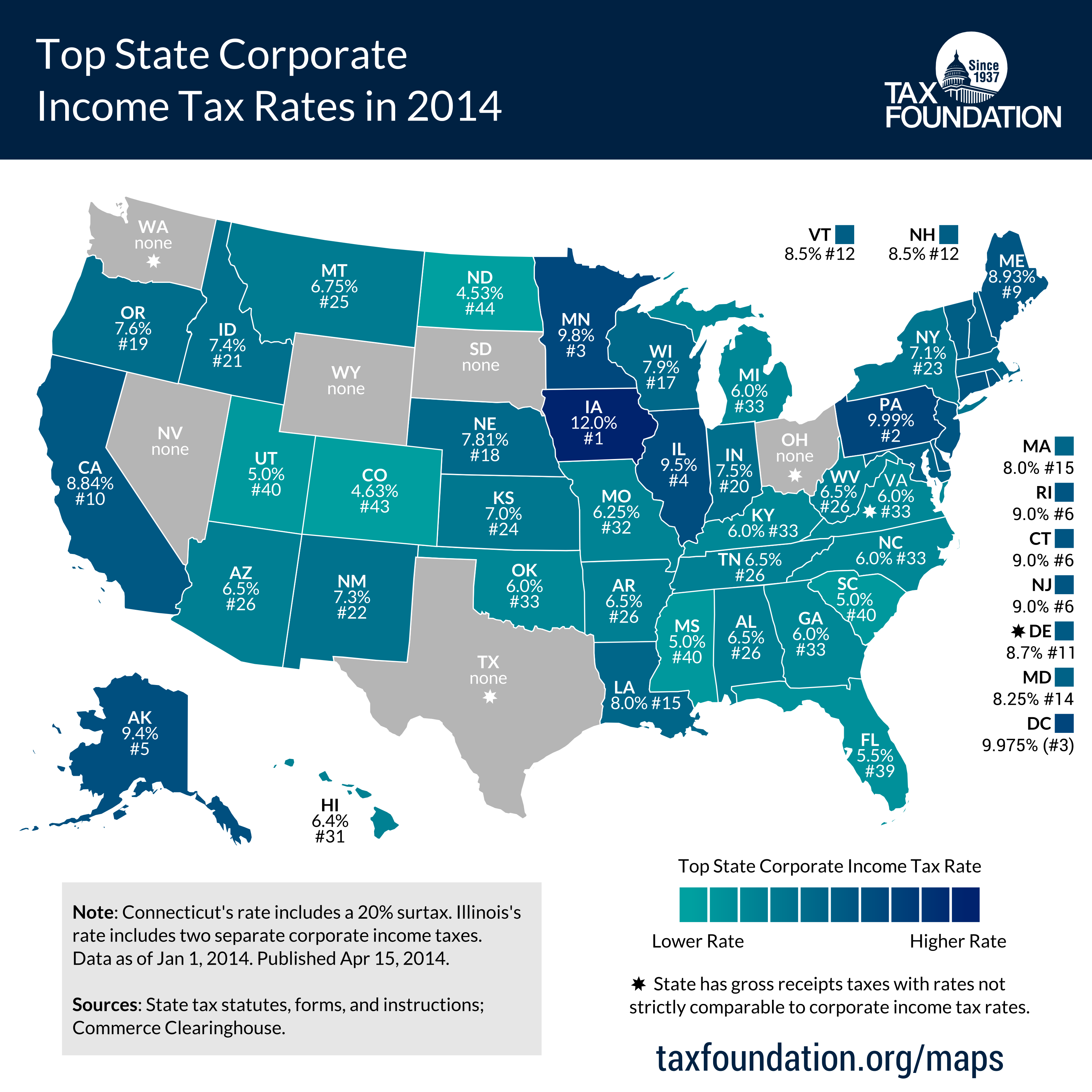

Top State Corporate Income Tax Rates In 2014 Tax Foundation

Business License Tax Seattle Business And Occupation Tax B O Tax Community Business Services Inc Tax And Accounting

Washington Updates Requirements For Investment Management Companies To Qualify For Reduced B O Tax Rate Deloitte Us

City Of Tacoma Tax License Pages 1 4 Flip Pdf Download Fliphtml5

%20Taxes/bo-tax-header.jpg)